In the context of rising gold demand, the international gold price has performed strongly since the beginning of the year, and has risen for five consecutive weeks, with spot gold and COMEX gold prices rising by more than 8%, repeatedly breaking through historical highs.

On January 31, spot gold in London exceeded $2,800 per ounce for the first time; On February 5, the COMEX gold price touched the $2,900 per ounce mark for the first time. On February 7, London gold closed at $2860.135 per ounce, up 0.15%; COMEX gold futures were at $2,886.1 an ounce, up 0.33%.

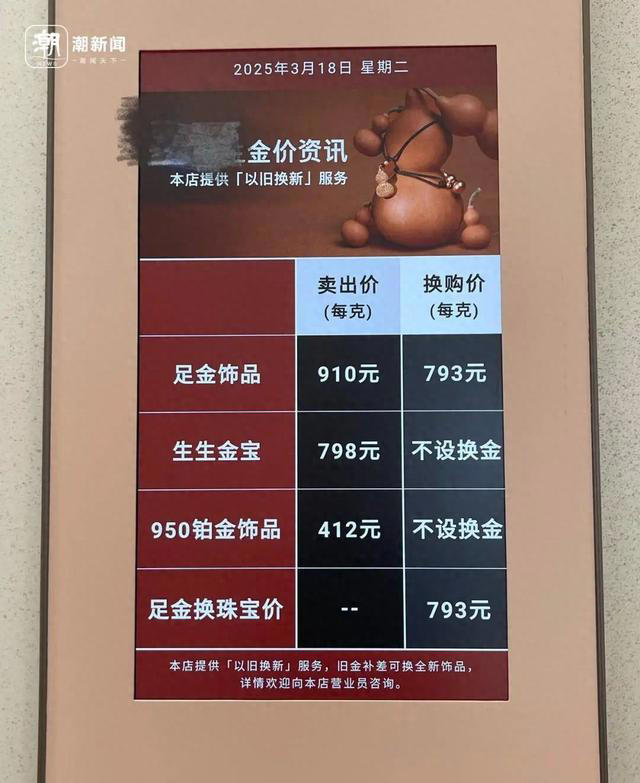

Recently, the price of gold has risen sharply, and the current price of gold jewelry has also risen, approaching 870 yuan per gram, which makes people call “gold prices have gone crazy”. At a time when the price of gold is rising, consumers’ wait-and-see sentiment is also becoming stronger, and small gram weight products are gradually “popular”.

Small gram weight products are popular

According to the Daily Economic News, after the Spring Festival holiday, Shenzhen’s Shuibei gold market gradually returned to normal from the hustle and bustle. In the past two days, the reporter visited the Shuibei gold market and found that with the rise in gold prices, consumers’ willingness to buy and wait-and-see sentiment coexist.

Taking February 7 as an example, on that day, the gold price in the Shuibei market was 675 yuan/gram, and the actual transaction price also needed to add processing fees ranging from 10 yuan to tens of yuan per gram, and the recycling price was 660 yuan/gram. On the working day after the holiday, there were fewer customers in the Shuibei market, and the reporter noticed that some consumers showed hesitation in the face of gold prices. A consumer told reporters that his budget was originally only a few thousand yuan, and seeing the recent continuous rise in gold prices, he was also worried about the risk of future declines, so he chose to wait and see for the time being.

The reporter saw in the market that there were also some foreign tourists who selected gold products in Shuibei. Mr. Wu’s family of three traveled to Shenzhen from other places and came to the Shuibei market, they told reporters that although the current gold price is high, as long as the appropriate amount is purchased, the total price difference is not big.

In the current market, many merchants have adjusted their sales strategies, thin gold banknotes, gold beans and other small gram gold jewelry in the water shell market began to become popular, and there are even a single weight of 0.2 grams of gold handicrafts, the total price is less than 200 yuan. Some merchants told reporters that the price of small gold jewelry is relatively close to the people, and exquisite styles can be bought for a few hundred yuan. For example, the price of gold jewelry weighing 1.32 grams is about 900 yuan, including the cost of braiding rope. During the New Year, themed products such as “Baby Snake” and “Peace and Joy” attracted many consumers. The person in charge of the store said that the number of people buying small gold jewelry has increased a lot, and it is also convenient to cash out at any time.

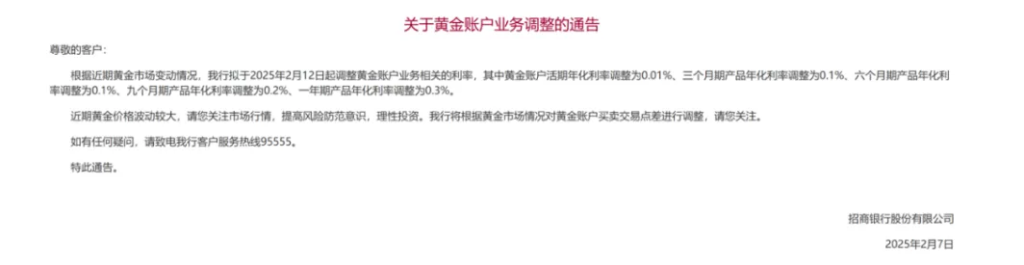

China Merchants Bank announced: downgrade

On February 7, China Merchants Bank announced that according to the recent changes in the gold market, it intends to adjust the interest rates related to the gold account business from February 12, of which the annualized interest rate of the current account is adjusted to 0.01%, the annualized interest rate of the three-month product is adjusted to 0.1%, the annualized interest rate of the six-month product is adjusted to 0.1%, the annualized interest rate of the nine-month product is adjusted to 0.2%, and the annualized interest rate of the one-year product is adjusted to 0.3%.

Image source: China Merchants Bank official websiteChina Merchants Bank has lowered the interest rate related to its gold account business by up to 30 basis points.

China Merchants Bank’s gold current and gold term products are both R3 risk level, of which gold fixed term supports direct cash purchase and gold current share transfer-in. In fact, while many banks have gold accumulation businesses, not all of them offer additional interest, in which case investors are only able to derive their income from fluctuations in the gold price. In addition, the operating rules of banks that pay additional interest on their MPF products also vary.

According to media reports, the reporter inquired about the current gold interest rate through the China Merchants Bank APP and found that the current annualized interest rate of the current gold account of China Merchants Bank is 0.1%, 0.3% for three months, 0.4% for six months, 0.5% for nine months, and 0.6% for one year.

In contrast, the interest rates of gold accounts of all maturities of China Merchants Bank have dropped sharply, and the shorter the product term, the greater the decline. For example, the one-year interest rate was reduced by 50% from 0.6% to 0.3%; The demand rate has been reduced from 0.1% to 0.01%, a drop of 90%, which is close to zero interest rate. A customer manager of China Merchants Bank told reporters that customers who invest in gold often trade frequently, generally only buy gold current, and almost never choose gold fixed, and hold it for no more than one year.

Analysts told reporters that gold investment income mainly comes from price rises and falls, rather than relying on interest, the recent surge in investors buying gold, if the interest rate is lowered, customers may not be sensitive to this, banks can reduce the cost of funds.

It is understood that the gold account is an account opened by China Merchants Bank for customers to record transactions related to customers’ gold shares. Customers can handle gold demand and gold fixed term related business through the gold account, both of which belong to the gold accumulation business, that is, the “paper gold” stored by the customer in the bank. Customers buy and sell according to the real-time gold price, and bear the profit and loss caused by the fluctuation of the gold price, and enjoy the share increase brought by the interest paid by the bank. When selling, investors can withdraw physical gold, or they can sell directly to obtain the corresponding monetary funds.

The world’s second-largest vault is tight

Physical gold delivery takes 4~8 weeks

According to Red Star News on February 8, citing CNN, in recent days, the world’s second largest vault has encountered a rare phenomenon, due to the crazy demand for gold bars, the staff of the Bank of England are overwhelmed, and it is currently necessary to wait for 4~8 weeks to get physical gold.

In general, the higher the demand, the more expensive the item, but the opposite is true for time-sensitive spot buyers. Normally, the spot price of gold in London is consistent offline, but now due to the queues at the Bank of England, nearby vaults with faster access to spot gold are selling gold at a higher price. It is reported that the vaults of financial institutions such as JPMorgan Chase and HSBC are only a few minutes’ drive from the Bank of England, and because of the faster pick-up of goods, these vaults can sell for $5 more per ounce than the Bank of England. Meanwhile, due to ample reserves, JPMorgan Chase & Co. plans to deliver more than $4 billion worth of gold bars, with a total weight of more than 30 million ounces, which would be the second-largest delivery on the New York Mercantile Exchange since data began in 1994.

Dave Ramsden, Deputy Governor for Markets at the Bank of England, is the first time in his years in the industry that he has witnessed such a scene. Ramsden said the demand for spot gold came mainly from the United States. On the one hand, there has been room for arbitrage in spot gold prices in the UK and the US; On the other hand, U.S. investors are currently worried that Trump will introduce tariffs that will significantly increase the cost of gold imports in the future. Due to strong spot demand, the one-month rental rate for gold in the London market has reached a staggering 4.7%, which is basically close to zero in normal market times.

Ramsden explained: “Unlike other financial assets, gold is a tangible, scarce asset with strict security measures and transport restrictions. You see, there are big trucks parked in front of our vault, all blocking my way to work. At the moment, the liquidity of spot gold in London has weakened significantly, and all capacity that can transport gold is fully booked. If you buy gold now, you’re bound to wait for many weeks. ”

On 5 February, the World Gold Council published its annual report, saying, “In 2024, against the backdrop of heightened geopolitical and economic uncertainty, global gold demand set new quarterly highs and annual total records.” According to the report, global gold demand reached a new high of 4,974t in 2024, up 1.5% from 4,899t in 2023, driven by central bank reserves and increased investment demand from global investors.

Ramsden said the Bank of England’s gold reserves had been rapidly depleted by 2% since 2025.

Entering China

Entering China