The news of “using the money in the personal account of medical insurance to buy a Huawei WATCH D2 blood pressure measurement watch at a pharmacy” has attracted the attention of netizens in many places. On February 8, a number of chain pharmacies in Guangdong, Hunan, Fujian and other places told the “Daily Economic News” reporter that some stores were already selling Huawei WATCH D2 before the Lunar New Year, because products that have obtained medical device registration certificates can be paid by medical insurance.

At a pharmacy in Shanghai, more than 100 people have registered for the Huawei WATCH D2. The clerk told reporters that you can use a medical insurance card to pay, and now it takes about a month to get the goods after registration.

According to the official website of the National Medical Products Administration, the Huawei WATCH D2 wrist ambulatory blood pressure recorder watch belongs to the second class of medical devices. Huang Xiuxiang, former secretary general of the Hunan Provincial Drug Circulation Association, told reporters on WeChat on February 8 that mechanical brand products can be swiped with personal accounts of medical insurance cards in some places, but the value of Huawei watches is relatively high.

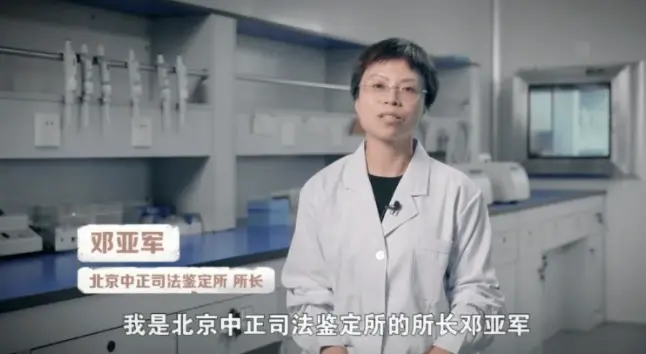

Image source: WeChat screenshot

Medical insurance personal accounts are available in many places

Buy a Huawei Watch at a pharmacy

On February 6, Mr. Li, who lives in Guangzhou, saw a poster posted by a nearby pharmacy staff on Moments, saying that the HUAWEI WATCH D2 with a retail price of 2,988 yuan per piece supports medical insurance payment. He searched on social platforms and saw that many netizens were sharing their experience of buying Huawei watches in pharmacies.

In pharmacies, Huawei watches with a unit price of nearly 3000 yuan are high-value commodities that can be paid with a medical insurance card, although they use the money of a personal account, but for some consumers who rarely use a personal account, it is a good choice. In the actual interview on February 8, the reporter learned that the product is generally in short supply in various pharmacies, and it is necessary to make an appointment in advance when purchasing, and it can only be paid with a medical insurance personal account, and the overall account cannot be used to pay.

The reporter of “Daily Economic News” noticed that the packaging box of the above-mentioned Huawei WATCH D2 was marked “pharmacy exclusive”. The person in charge of a chain pharmacy in Xiamen told reporters on the 8th that their pharmacy has sold hundreds of watches, and the sales are good, mainly because you can use your personal account to swipe the full amount.

On February 8, in an interview with a number of pharmacies in Shanghai, the reporter also found that the WATCH D2 was generally “out of stock”, but it was available for appointment.

A staff member at a Fahrenheit pharmacy on Beiai Road said that Huawei-related products had been sold in the store before, but they have been sold out so far, and the specific replenishment time is yet to be determined. If consumers are interested in purchasing, they can leave their contact information and notify them when they are available. In response to the question of “whether it is possible to pay with a medical insurance account”, the other party introduced: “If there is money in the medical insurance account, it can be deducted directly.” If the balance of the current year is insufficient, the current year will be deducted first, and then the calendar year. ”

The staff of Yifeng Pharmacy Sanquan Road Store said that at present, only “Huawei Blood Pressure Monitor” is on sale, and there is also no stock for the time being, so an appointment is required. The staff said that the company did not inform the specific arrival time, and consumers could only leave information and wait. In terms of payment, the store also supports the use of medical insurance personal accounts for purchases: “If there is 3,000 yuan in the personal account, it will be deducted directly.” If it is not enough, a part of it can be deducted from the personal account, and the rest can be made up by cash. The staff of the pharmacy also said that the medical insurance pooling account could not be used to purchase the product.

At the No. 1 Medical Store on Nanjing East Road in Shanghai, a staff member pointed to a multi-page list with more than 100 people waiting in line, saying, “We have to wait at least a month.” According to the above-mentioned staff, the store is currently selling “Huawei Qingyun H9D20 wrist ambulatory blood pressure recorder”, which is different from the Huawei watch version that the reporter proposed to buy but has the same function, but the spot has been sold out. The reporter asked whether it supported medical insurance payment, and the other party replied affirmatively: “Yes, you can swipe your medical insurance personal account.” ”

The reporter noticed that on the side of the cashier counter of the pharmacy, a special “Wrist Ambulatory Blood Pressure Recorder Activation Link Tutorial” was also posted for everyone to view.

Expert: Centralized payments are possible

Let some local medical insurance funds be tight in the short term

One of the points of controversy is whether it is reasonable for consumers to buy Huawei watches by “swiping medical insurance”. To understand this issue, we must first clarify the difference between a health insurance pooling account and an individual account.

The official WeChat account of the National Health Insurance Administration has issued a document introducing: total medical expenses = medical insurance co-ordination (fund) payment + individual self-payment + individual self-payment. Among them, the medical insurance co-ordination payment refers to the medical expenses that belong to the scope of the medical insurance catalogue and are paid by the basic medical insurance co-ordination fund according to the regulations, “that is, the part directly reimbursed by the medical insurance, and this part does not need to be paid by yourself”. Personal self-payment refers to the medical expenses that need to be borne by patients within the scope of the medical insurance catalog, which can be paid by the balance in the personal account of the medical insurance first, and the insufficient part can be paid in cash.

In its reply to Recommendation No. 7215 of the Second Session of the 13th National People’s Congress, the National Health Insurance Administration has made it clear that personal accounts can be used to pay for medical expenses incurred in designated medical institutions or designated retail pharmacies within the scope of the items specified in the basic medical insurance drug catalog, the scope of diagnosis and treatment items, and the standards for medical service facilities, and it is prohibited to use them for other consumer expenditures other than medical insurance.

The National Medical Security Administration’s reply to Recommendation No. 6300 of the Second Session of the 13th National People’s Congress shows that some localities have carried out corresponding explorations from the perspective of further giving full play to the ability of personal accounts to pay medical expenses, such as expanding from the purchase of drugs to the purchase of medical consumables and medical devices, etc., to reduce the precipitation of funds in personal accounts, improve the efficiency of fund use, and promote the stable and sustainable development of the employee medical insurance system.

The “Daily Economic News” reporter inquired on the official website of the State Drug Administration that the product registration name of the “Huawei Watch” mentioned by the above-mentioned person is “Wrist Ambulatory Blood Pressure Recorder”, which obtained the Class II medical device registration certificate issued by the Guangdong Provincial Drug Administration on August 5, 2024, which means that this product can be sold as a compliant medical device by pharmacies.

Regarding the scope of application of medical insurance personal accounts, many places have previously issued detailed rules to regulate the use of medical insurance personal accounts.

For example, the Shanghai Municipal Medical Security Administration, the Shanghai Municipal Drug Administration, and the Shanghai Municipal Commission of Commerce jointly issued a notice in June 2023 that from July 1, 2023, the funds in the personal account can be used to pay for the expenses incurred by the insured persons in the city in the purchase of medical devices and medical consumables in designated retail pharmacies。 When the insured person purchases, the personal account will be included in the fund payment in the current year, and the insufficient part will be paid by the surplus funds of the previous year; If the funds in the personal account are insufficient, the funds in the family mutual aid account may be used to pay according to regulations; If you purchase device consumables and drugs at the same time, the device consumables will be settled with personal account funds before the drugs.

In the relevant regulations of Hunan and other provinces, it is shown that “personal accounts can be used to pay for the expenses incurred by individuals in the purchase of drugs, medical devices and medical consumables in designated retail pharmacies.” ”

According to reports, there has been a clear reply from the local medical security bureau recently, and the purchase of Huawei watches is within the scope of use of medical insurance personal accounts.

It can be seen that swiping the medical insurance personal account to buy a Huawei watch also depends on the local policy.

For the suspension of medical insurance to buy Huawei watches in some areas, in addition to considering that Huawei watches belong to consumer electronics, Huang Xiuxiang believes that there is another consideration involved in this – the allocation of personal account fees in some places has changed. Huang Xiuxiang further explained that in the past, personal accounts and bank cards in many places were bound, and the monthly fees transferred to personal accounts were actually transferred to bank cards, but now they are given to a virtual account through the medical insurance card, and a certain amount is allocated every month.

“Now the settlement cycle agreed between the medical insurance agency and the designated medical institution is 20 days, and for the places where the current payment itself is under pressure, centralized payment will make the medical insurance funds tight in the short term.” Huang Xiuxiang analyzed.

Entering China

Entering China