Outburst! The largest theft in history, 10.8 billion yuan of cryptocurrency was stolen, and the market was shaken! The company responds urgently, and the thieves are exposed! Industry insiders: It shouldn’t be able to catch it back

On the evening of February 21, Beijing time, the cryptocurrency trading platform Bybit was hacked, and the scale of the attack was huge, and more than 400,000 ETH and stETH with a total asset value of more than 1.5 billion US dollars (about 10.8 billion yuan) were transferred to an unknown address.

Conor Grogan, head of cryptocurrency market trading platform Coinbase, said the hack was the largest theft in history, surpassing the theft of the Central Bank of Iraq (about $1 billion).

Founded in 2018, Bybit is one of the world’s largest cryptocurrency exchanges, with an average daily trading volume of over $36 billion. According to CoinMarketCap data, Bybit’s platform assets were about $16.2 billion before the hack, which means that the stolen ETH is equivalent to about 9% of its total assets.

This sudden asset theft incident has dealt a heavy blow to the industry.

Affected by this, in the early morning of February 22, the cryptocurrency market collectively fell, and Bitcoin fell sharply for several short periods, falling below $95,000 per piece within 24 hours and reaching as low as $94,830.3 per coin. In the past 24 hours, more than 170,000 people around the world have liquidated their positions.

It’s worth noting that this hack was an attack on a cryptocurrency exchange, not the cryptocurrency itself. The attack compromised Bybit’s cold wallet, an offline storage system designed for security. An industry insider believes that the stolen coin should not be recovered, and he himself has taken the coin back and put it in his wallet. Tom Robinson, chief scientist at blockchain analytics firm Elliptic, said in an email: “We label the thieves’ addresses in our software to prevent these funds from being cashed out through any other exchange. ”

Hacking,stealing from BybitNearly $1.5 billion in cryptocurrency

On the evening of February 21, Beijing time, ZachXBT posted that it had detected a suspicious outflow of more than $1.46 billion from Bybit.

Research firm Arkham Intelligence also confirmed that about $1.4 billion had flowed out of the exchange, posting on platform X: “These funds have begun to be transferred to new addresses and are being sold.” ”

Since then, Bybit has officially released a detailed announcement of the incident. According to some media, the announcement shows that at 20:30 Beijing time on February 21, Bybit detected unauthorized activity in the Ethereum cold wallet during routine transfers. The transfer is part of Bybit’s official plan to transfer ETH from ETH multisig cold wallets to hot wallets. Unfortunately, the transaction was manipulated by a sophisticated attack that altered the smart contract logic and hid the signature interface, allowing the attacker to take control of the ETH cold wallet.

As a result, more than 400,000 ETH and stETH with a total asset value of more than $1.5 billion were transferred to an unknown address.

Regarding the hacking incident, Bybit said that all other cold wallets under Bybit are secure, customer funds have not been affected, and please be wary of other scams. Bybit’s reserves are strong and 1:1 backed, and all client assets are fully protected, which can be viewed on the Proof of Reserves (PoR) webpage. With more than $20 billion in assets under management, Bybit will use bridge loans if necessary to ensure user funds are available. The Bybit platform and all other services, including trading products, cards and P2P, are operating normally.

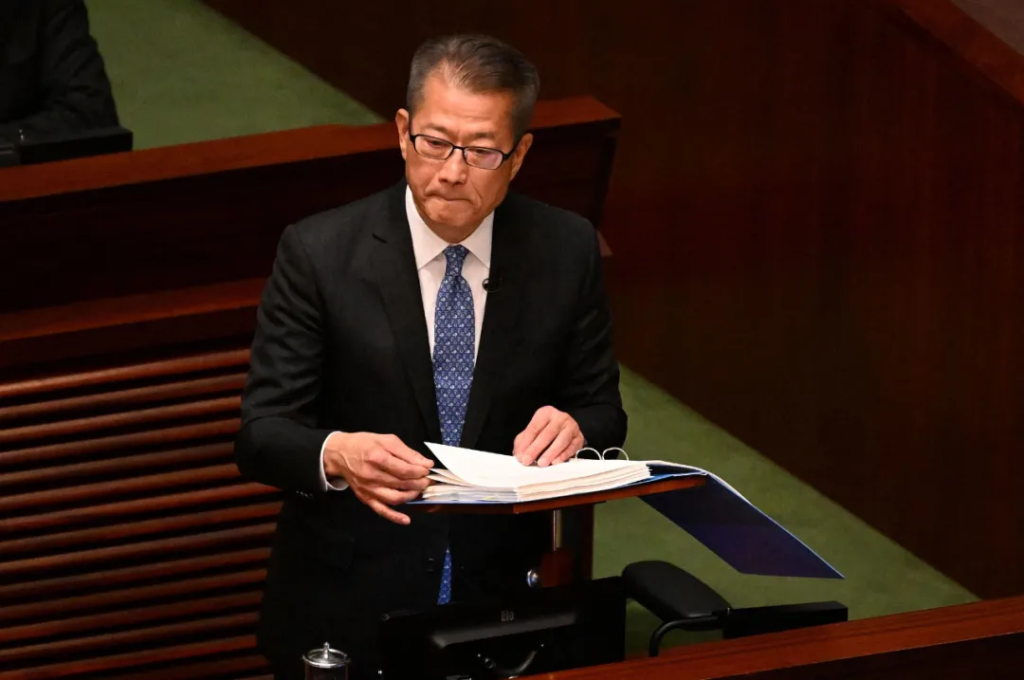

Bybit CEO Ben Zhou also posted on the X platform on Friday acknowledging the incident. To address customer concerns, Zhou also conducted a live broadcast, emphasizing the safety of the exchange’s funds and revealing that the platform has applied for a bridge loan with its partners and has raised about 80% of the funds to cover the losses. At the same time, Bybit will try to recover the funds and take the necessary legal action against the hackers.

Zhou assured users during the livestream: “Your funds are safe and our withdrawal channel remains open. After the hack, the exchange has processed more than 70% of withdrawal requests. He also said that the exchange is not currently buying any ETH to cover the stolen assets.

The largest theft in history

Security agencies confirmed that the attackers were the Lazarus Group, a hacker group that hacked into a South Korean exchange in 2017 to steal $200 million in bitcoin.

According to blockchain analytics firm Elliptic, the hack became the largest crypto theft in history, and Rob Behnke, co-founder and executive chairman of blockchain security firm Halborn, even said it could be “the biggest event ever, not just in the crypto space.” ”

Conor Grogan, director of Coinbase, also said that the Bybit hack became the largest theft in history, surpassing the theft of the Central Bank of Iraq (about $1 billion).

Industry experts warn that the incident exposes a fatal vulnerability in cold storage on centralized exchanges – smart contract code vulnerabilities can be exploited even when stored offline. Investors accelerated their shift to hardware wallets and decentralized exchanges, with 24-hour trading volume on DEXs surging by 40%.

Separately, Hilary Allen, a professor at American University Washington College of Law who studies the cryptocurrency market, said: “Before such an attack, a deregulated market sounded good. In the short term, we’re seeing a lot of people cheering the removal of a lot of regulation. But be careful with your wishes.

Affected by this, Ethereum plummeted 6.7% in 24 hours, Bitcoin fell 3%, and 170,000 people liquidated more than $570 million. Bybit’s token BYB plummeted 12.3% in one hour, and the futures market liquidated more than $200 million in long positions.

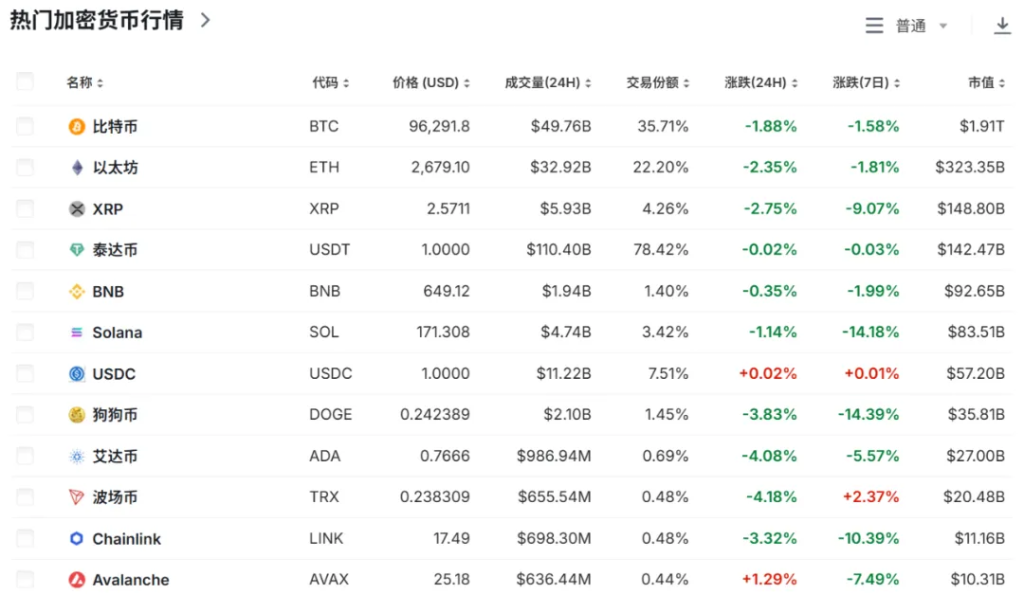

As of press time, the crypto market fell narrowly, with Bitcoin down 1.88% in 24 hours and Ethereum down 2.35% in 24 hours.

Entering China

Entering China