Mobile payment, public transport card, electronic access control, and the near-field communication technology of smartphones in daily life, which is often referred to as the NFC function, have brought us a lot of convenience. Recently, some short videos have appeared on the Internet claiming that “through close contact payment methods, the money in the mobile phone was stolen in the air”, and after the release of these videos, it has caused widespread heated discussions among netizens. Is it true that “if you touch the money”, “touch it and the money will be gone”?

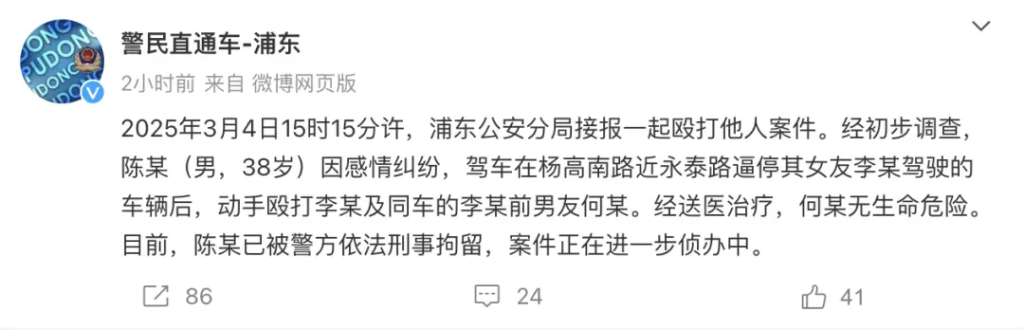

The “touch it and steal it” video is a posed film, and the rumor-monger was detained

In the video, the short video blogger posted a video on multiple online platforms saying that his assistant used the “touch” convenient payment method of a payment software to check out after eating, and after checkout, when the assistant put the mobile phone back in his pocket, a stranger used a disguised POS machine to steal 500 yuan, and then they recovered the money by calling the police.

After the video was released, it quickly aroused discussions among many netizens, and the payment platform found that there were many factual errors in the short video after learning about the incident, and reported the incident to the police.

After the public security organs launched an investigation as soon as possible, they summoned the publisher Wu X to the case handling site for questioning in accordance with law. It was found that the short video was Wu’s “posing” behavior to win traffic and attract attention. According to the relevant provisions of the “Public Security Administration Punishment Law of the People’s Republic of China”, Wu was fined 500 yuan by the public security organs for fabricating and spreading online rumors in accordance with the law, and publicly apologized through the online platform.

Experts demonstrate the principle of “touching”: it is unrealistic to steal at close range

After an investigation, the police determined that the online video was “posed” for the purpose of gaining traffic, and the online blogger was also punished by law, but the concerns of netizens were not dispelled. Many people like to use the “touch” payment function launched by the payment platform in life, and the premise of this function is that the NFC function on the mobile phone needs to be turned on. In order to verify whether this technology of “stealing money by touching it” really exists, the reporter also asked experts to make a demonstration.

The reporter contacted the product security expert of the payment platform, and he demonstrated the payment process of “touching” for us.

Gao Zheng, a payment platform product security expert: “Touch” the whole payment process is still very simple, we can actually try it, once the merchant initiates the collection, at this time the user only needs to unlock the mobile phone first, directly touch it on the machine, and you can quickly complete a payment.

Reporter: Can the mobile phone be successfully paid in a locked state?

Gao Zheng, payment platform product security expert: There is no way for the user’s mobile phone to “touch” the payment in the locked state, which is a very important step to ensure the safety of the user’s funds, and the user must unlock the mobile phone before touching.

For the convenience of the demonstration, the expert will demonstrate the operation after turning on passwordless payment. According to reports, the “touch” payment will be adjusted in combination with different payment scenarios, transaction risk control and other factors, especially for large-value transactions and risky transactions, users will be required to reconfirm through passwords, fingerprints, faces, etc., to ensure payment security.

Gao Zheng, a payment platform product security expert: It turns out that the user may pay through the two-dimensional code of the mobile phone exhibition, and “touch” is equivalent to the user through the cloud after the touch of a way to send barcode information to pay, in fact, “touch” payment is very similar to the common scan code payment and face scanning payment, they are the underlying technical means are barcode payment, most of these payment methods also need to be carried out in the case of a network, In this way, it can be guaranteed by the network’s risk control system to ensure the security of everyone’s payment process, and if there are some suspicious situations in the payment process, it will trigger the second verification of users or even stop the transaction.

The reporter learned that whether it is “scan” payment or “touch” payment, it only plays a role in the verification of the payment process, although “touch” uses some functions of NFC, but does not store and transmit the user’s payment information through mobile phone NFC, so the offline payment process is not as rumored on the Internet will be easily touched and stolen at close range.

Police: NFC theft costs are high, and remote control needs to be guarded against

NFC, short for Near Field Communication Technology, is a short-range wireless communication technology that allows devices to exchange data within 10 centimeters. We just read the expert’s analysis from the technical level, on this issue, the reporter also consulted the police, in the process of offline payment, how big is the risk of property damage caused by the use of the “touch” payment function?

Luo Yongji, police officer of the Anti-Fraud Center of the Hangzhou Municipal Public Security Bureau: Before the launch of any payment method, a large number of security verifications must have been done, and it is relatively safe and reliable. If there is a theft in extreme cases, and someone else uses the NFC function of the mobile phone to pay for your bank card in close proximity and steals the money, it is a contact crime in the first place. Some of the code scanning equipment he wants to use, contact equipment such as POS machines, touch and other equipment are all handled with real names, and offline operations, the cost of this type of crime is quite high, and the detection rate is very high. Judging from the current actual situation, we should guard against this kind of remote contactless fraud.

Police tip: “Remote contactless scams” usually follow a three-step process

The remote non-contact fraud mentioned by the police is one of the most common telecommunications fraud methods in recent years. First of all, fraudsters disguise their identities and often use “flight failure” and “deduction cancellation” as reasons to cause victims to be nervous and reduce their vigilance. Second, fraudsters will ask victims to bind their bank card information to fake app software through the NFC function, and directly read and transfer the funds in the card. To further increase trust, they also trick victims into using techniques such as screen sharing, so that they mistakenly believe that they are doing something legitimately. What should we do in this situation? The police also helped.

Luo Yongji, police officer of the Anti-Fraud Center of the Hangzhou Municipal Public Security Bureau: We must first be vigilant, and we must verify through official channels for this kind of self-proclaimed customer service to give you all kinds of refunds, and do not blindly believe it. In the name of refund, fraudsters trick victims into doing things and get them to turn on screen sharing. Once screen sharing is enabled, fraudsters can see any actions of the victim, including bank card numbers, passwords, and verification codes. Wait a minute. Once this information is obtained, the scammer can remotely log into the victim’s account to transfer money. If someone remotely asks you to turn on the NFC function and verify it by sticking a bank card to your mobile phone, once the bank card is attached to your mobile phone, the money can be transferred, and the scammer turns the victim’s mobile phone into a POS machine, and an order is generated remotely by letting the victim download the App, and the victim’s bank card is equivalent to a POS machine when the mobile phone is fastened.

Police tips: When you receive a call claiming to be a customer service, be sure to verify their true identity, especially when sensitive information such as changes and refunds are involved. Avoid unfamiliar payment operations through NFC, and be wary of all actions that require screen sharing or remote assistance. Once you notice that you have been deceived, you should immediately call the bank’s customer service number to freeze the bank card and report it to the police.

Luo Yongji, police officer of the Anti-Fraud Center of the Hangzhou Municipal Public Security Bureau: Once someone remotely guides you to turn on screen sharing and turn on the NFC function, it must be a fraud. For the sake of security, we can also turn off this passwordless payment function, and if you find it inconvenient, you can reduce the passwordless payment limit as much as possible.

Entering China

Entering China