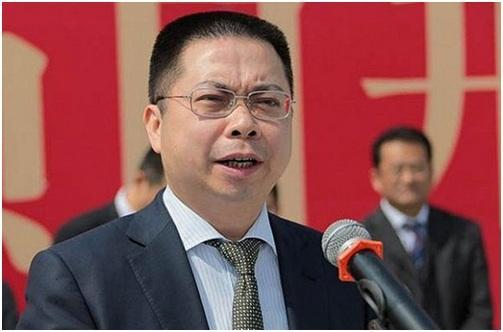

Yao Zhenhua, who was once famous in the capital market because of the “Baowan dispute”, and his Baoneng department at the helm have attracted market attention in recent years because they are in debt trouble.

Tianyancha shows that Yao Zhenhua has added a new information on the person subject to execution, with an execution target of 3.67 billion yuan, which is the largest case to be executed since the beginning of 2025. At the same time, Tianyancha shows that as of now, Baoneng Group has 96 pieces of information on persons subject to execution, with a total amount of more than 46.3 billion yuan. The latest piece of information on the person subject to enforcement was filed on February 25.

Previously, Baoneng continued to expand its territory in the financial sector, once covering property insurance, life insurance, public offering, financial leasing, small loans and other fields. However, the financial territory of Baoneng, which is in debt trouble, is also compressing. Recently, the equity auction of Xinjiang Qianhai United Fund Management Co., Ltd. (hereinafter referred to as “Qianhai United Fund”) held by Jushenghua, a subsidiary of Baoneng, was successful, and Jushenghua will lose the largest shareholder of the fund company after the transaction is completed.

In response to issues such as debt and the development of the financial sector, the reporter of the Financial Associated Press sent an interview letter to Baoneng, but as of press time, the other party has not replied. Interviewees in the industry believe that the imminent change of ownership of the fund license also means that the Baoneng financial sector is shrinking and the synergy with other financial licenses will be affected. In the future, what changes will be made to the financial territory of Baoneng, and how it will develop, has attracted much attention from the market.

In the first two months of the year, more than 4.7 billion yuan was executed, and the total amount of Yao Zhenhua’s execution has approached 50 billion yuan

Specifically, Yao Zhenhua’s new information on the person subject to enforcement, the subject of enforcement is 3.67 billion yuan, the enforcement court is the Beijing Financial Court, and the first enforcement date is February 20.

According to Tianyancha, in addition to the huge enforcement case of 3.67 billion yuan, Yao Zhenhua has been continuously executed by many courts since the beginning of 2025. Overall, Yao Zhenhua, as the person subject to enforcement, has a total amount of more than 48.9 billion yuan. Among them, since 2025, the total amount executed will reach 4.788 billion yuan.

Yao Zhenhua, as the helmsman of the Baoneng Department, had previously made a name for himself in the capital market because of the “Baowan Dispute”. Baoneng has also used its Qianhai Life Insurance and other companies to “sweep” the A-share market and obtain control of many listed companies such as Zhongju High-tech. However, in 2021, the Baoneng debt crisis broke out. In recent years, Baoneng’s assets have also continued to appear on auction platforms, and in addition, the control of its listed companies has also been lost.

On debt-related issues, the reporter of the Financial Associated Press sent an interview letter to Baoneng, but as of press time, the other party has not replied.

The reporter of the Financial Associated Press noted that on December 17, 2024, Baoneng Group had said that since the temporary liquidity difficulties of the enterprise, it has communicated with various institutions and made new progress in debt reconciliation. Settlement agreements have been signed with most of the creditors, and some of them have reached the intention of reducing the debt and issued a preliminary plan. Among them, the asset management company with the largest stock balance of tens of billions of yuan, the two sides reached a restructuring intention, and signed an agreement on the intention to restructure claims and debts in mid-November.

Baoneng Group also said that through debt reconciliation and other means, it achieved more than 30 billion yuan of debt in three months, and at the same time, Baoneng Group also enhanced the profitability of the enterprise by optimizing internal management and improving operational efficiency, so as to provide guarantee for the advancement of debt reconciliation.

Baoneng’s debt problems appear to be continuing. The reporter of the Financial Associated Press noticed that as of press time, Tianyancha showed that Baoneng Group has 96 pieces of information on persons subject to execution, with a total amount of more than 46.3 billion yuan. The latest piece of information on the person subject to enforcement was filed on February 25. Since 2025, the total amount executed has reached 2.125 billion yuan.

Its financial license passively “reduced” the management scale of Qianhai United Fund has been shrinking in recent years

Under the debt dilemma, many of Baoneng’s assets were auctioned and disposed of, and the financial territory was also affected. Among them, the equity of Qianhai United Fund held by Jushenghua was won by Shanghai Securities in the recent auction, and after the completion of the equity auction, Shanghai Securities will replace Jushenghua as the largest shareholder of Qianhai United Fund.

In the introduction of Baoneng Group’s official website, regarding the industrial layout of financial technology and financial services, the name of Qianhai United Fund is listed as an example of key financial institutions. Qianhai United Fund is a fund management company approved by the China Securities Regulatory Commission and a public fund manager with a registered capital of 200 million yuan. It mainly provides professional asset management services for various institutional and individual investors at home and abroad.

Regarding the impact of losing the seat of the largest shareholder of Qianhai United Fund, the reporter of the Financial Associated Press sent an interview letter to Baoneng, but as of press time, the other party has not replied. Wang Pengbo, a senior analyst in the financial industry at Broadcom Analysis, said in an interview with the Financial Associated Press that in terms of synergy with other financial licenses, the loss of control of fund companies may not have a small impact, and in addition, the influence in the financial field will also be weakened.

It is understood that since the first listing of the equity of Qianhai United Fund held by Jushenghua in March 2024, the starting price has shrunk from 47.07 million yuan all the way to 37.66 million yuan. After many unsuccessful auctions, it was finally won by Shanghai Securities recently. The transaction price of 37.6622 million yuan is significantly lower than the starting price, and at the same time, it is greatly discounted from the appraised value of 67.254 million yuan.

Looking back, in August 2015, Qianhai United Fund was formally established, of which Jushenghua invested 60 million yuan, accounting for 30% of the shares, to become the largest shareholder.

Wind shows that from its establishment to 2020, the total asset management scale of Qianhai United Fund once reached a high of 49.6 billion yuan, however, the scale has shown a downward trend since then, and the latest data shows that the management scale of Qianhai United Fund is only 9.75 billion yuan.

Where is Baoneng’s financial sector headed?

In addition to funds, Baoneng’s financial sector also covers property insurance, life insurance, financial leasing, small loans and other fields, with a wide range of financial layouts.

On the official website of Baoneng Group, in the introduction of the part of financial technology and financial services on the industrial layout, the reporter of the Financial Associated Press found that among the examples of key financial institutions, in addition to Qianhai United Fund, Qianhai Life, Xinjiang Qianhai United Property Insurance Co., Ltd. (hereinafter referred to as “Qianhai Property Insurance”), and Shenzhen Guangjin United Investment Co., Ltd. (hereinafter referred to as “Guangjin Exchange”).

It is understood that Qianhai Life Insurance was established in February 2012, and Jushenghua, a subsidiary of Baoneng, is one of the shareholders. While obtaining a life insurance license, Baoneng’s financial territory continues to expand. Qianhai Property Insurance was established in 2016, and one of the five initiators of Qianhai Property Insurance is Jushenghua, a subsidiary of Baoneng. As a result, Baoneng has dual licenses for property insurance and life insurance in the insurance field.

In addition, Baoneng also has Shenzhen Yueshang Microfinance Co., Ltd., established in January 2012, which is a financial institution specializing in microfinance business approved by the Financial Office of Shenzhen Municipal Government, with a registered capital of 200 million yuan. Tianyancha shows that up to now, there are 9 surviving companies in the financial industry of Jushenghua’s foreign investment enterprises under Baoneng, including Yunxin Credit Rating Co., Ltd.

According to the official website of Baoneng Group, Qianhai Life Insurance is the first national financial and insurance licensed institution headquartered in Qianhai Shekou Free Trade Zone, with a registered capital of 8.5 billion yuan and more than 100 branches in Shenzhen, Guangdong, Shanghai, Jiangsu, Sichuan, Hubei, Shandong and other places.

Qianhai Property & Casualty Insurance is a national financial and insurance licensed institution with a registered capital of 1 billion yuan, providing property insurance, liability insurance, short-term health, accident insurance and other risk protection services for individuals, families and enterprises, and serving more than 20 million customers in Internet business. GFEX’s business segments include financial leasing asset transactions, commercial factoring, asset management, etc.

From the perspective of development, it is difficult to be optimistic about the operation of some of its financial institutions under the background of the liquidity crisis of Baoneng. Wind shows that from 2016 to mid-2023, Qianhai P&C Insurance will lose money in all other years, except for a profit of 10 million yuan in 2016 and 23 million yuan in 2022. From 2017 to 2021, the net profit of Qianhai Property Insurance was 133 million yuan, 221 million yuan, 130 million yuan, 72 million yuan, and 18 million yuan respectively, and the net profit loss in 2023 was 89 million yuan.

In addition, at the end of December 2021, Qianhai Life’s total assets were 372.056 billion yuan and net assets were 28.514 billion yuan, ranking 9th in the market with a market share of 3.09%. However, since April 2022, Qianhai Life has suspended the disclosure of solvency reports, and has not disclosed annual reports in 2022 and 2023.

Tianyancha shows that from 2021 to 2024, the number of judicial cases involved in Qianhai Life Insurance is basically increasing year by year, reaching 63 cases in 2024. Of the cases involved so far, 81.17% of them are defendants. In addition, according to Tianyancha, the 200 million yuan equity of Guangjin held by Jushenghua has been frozen, and the freezing period is from October 7, 2023 to October 6, 2026.

In the future, what changes will be made to the financial territory of Baoneng, and how it will develop, the reporter of the Financial Associated Press will continue to pay attention.

Entering China

Entering China