On February 25, Baidu announced the acquisition of YY Live, a subsidiary of Huanju Group, with a transaction value of about 2.1 billion US dollars (about 15.2 billion yuan).

The dust has finally settled on the acquisition, which lasted for four years and went through twists and turns. The value of the deal shrank from $3.6 billion to $1.5 billion. After the “bargaining” acquisition, Baidu announced that it would invest more than 11 billion yuan in AI.

It is worth noting that just one day before the acquisition, Liu Xiaodan, the queen of mergers and acquisitions, joined Baidu’s board of directors. There is more money and people are coming, which may add a different color to the AI competition of large manufacturers.

A one-off merger?

After 4 years, Baidu won YY

Let’s start with the details of the transaction.

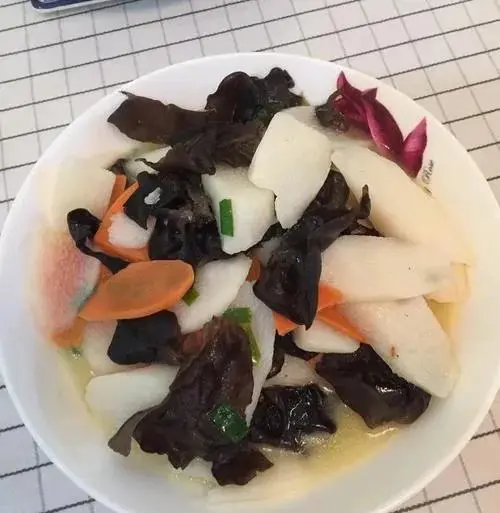

According to the announcement of the Hong Kong Stock Exchange, Baidu and Huanju Group have reached an acquisition agreement, and Baidu has paid about 2.1 billion US dollars (about 15.2 billion yuan) to acquire Huanju Group’s video entertainment live broadcast business in China, namely YY Live.

The company previously received about US$1.86 billion in February 2021, and on the same day, the company received about US$240 million in cash consideration.

For YY live broadcast, the Internet circle is no stranger. In 2005, Li Xueling, the former content director of NetEase, established Huaduo Technology, the predecessor of Huanju Group, in Guangzhou, and Lei Jun invested the first money.

In 2008, Li Xueling launched YY Voice, an instant messaging software for game communication, and in just two years, the number of people online at the same time exceeded 5 million. Around 2011, YY Live was launched, and Huanju Group became the first company in China to carry out game live broadcast business. JOYGROUP was successfully listed on NASDAQ in the United States.

In November 2020, Baidu announced that it had signed a definitive binding agreement with Huanju Group to wholly acquire “YY Live”, including but not limited to YY mobile applications, YY.com websites, YY PC clients, etc., with a total transaction amount of about 3.6 billion US dollars (about RMB 23.699 billion), and the transaction is expected to be completed in the first half of 2021.

For this acquisition of more than 10 billion yuan, Baidu CEO Robin Li once said on the earnings call that Baidu has 300 million daily active users, and the merger and acquisition of YY is very natural for traffic monetization. As a large-scale live broadcast platform, YY has accumulated rich experience, and Baidu Live has a lot to learn from.

Surprisingly, 3 days after the announcement of the acquisition, the well-known short-selling agency Muddy Waters raised the question that YY Live “is suspected of fraud in terms of revenue, profits, paying users and other data”.

Shorting in muddy waters did not affect the continuation of mergers and acquisitions. In February 2021, Huanju Group announced that the sale of YY Live to Baidu had been basically completed. In March of the same year, Baidu also said in the announcement that the acquisition had been basically completed, and some customary matters were expected to be completed in the near future.

However, on January 1, 2024, three years after the agreement was signed, Baidu announced that it would terminate the acquisition agreement.

Baidu’s reasoning was that the share purchase agreement stipulated that the closing of the acquisition would be subject to certain preconditions, including the necessary regulatory approvals, and that either the buyer or seller would have the right to terminate the agreement if the acquisition was not completed by the final deadline.

Now, after four years of twists and turns, the two sides may take a step back, and the transaction amount has been reduced from $3.6 billion to $2.1 billion, and Baidu has finally bagged the YY live broadcast business.

Baidu has brought in the queen of mergers and acquisitions

Coincidentally, almost at the same time, Baidu announced on the Hong Kong Stock Exchange that it had appointed Liu Xiaodan to replace Brent Callinicos as the new independent director and chairman of the audit committee of the board of directors.

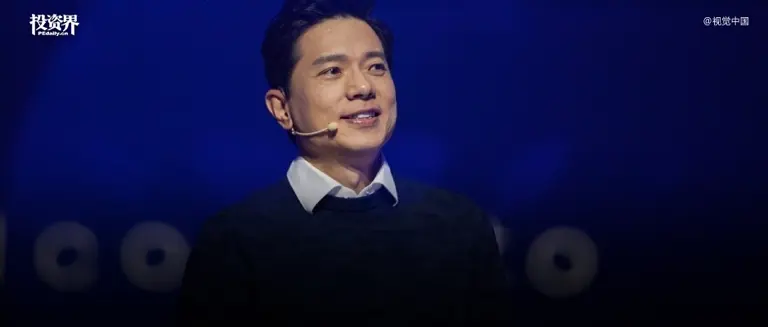

No one in the merger and acquisition knows Liu Xiaodan. Graduated from Peking University, Liu Xiaodan has a brilliant investment banking career of nearly 20 years, was the soul of Huatai United, and handled many classic cases, from which the “Queen of M&A” comes from. In 2019, Liu Xiaodan and his former subordinates jointly established Chenyi Fund, focusing on mergers and acquisitions.

In January 2021, Chenyi Investment announced the completion of its first RMB M&A fundraising, with a total scale of 6.8 billion yuan, focusing on three major areas: medical and health, consumer and service, technology and manufacturing.

From 2020 to the present, Chenyi has successively invested in many projects such as Hualan Biotechnology, BYD Semiconductor, China Innovation Airlines, V-SOL Semiconductor, Changjing Technology, Lisui Technology, Ruichen Pet Medicine, Hisun Animal Protection, Stam and many other projects. In addition, Morning One Fund has also cooperated with Mindray Medical to establish a medical industry fund, and WuXi AppTec has cooperated to set up a medical M&A fund.

In March last year, Daniel Zhang, the former CEO of Alibaba, joined Morning One Fund and co-served as the managing partner with founder Liu Xiaodan.

This time, Baidu invited Robin Li’s Peking University alumni, perhaps sending a positive signal.

On the other hand, after the completion of the merger and acquisition transaction between Baidu and Huanju Group, the US$1.6 billion (more than 11 billion yuan) previously deposited into the escrow account has been fully refunded to Baidu. Baidu said it plans to invest the money in cloud computing and AI infrastructure.

This also means that Baidu has more bullets thrown into AI.

Recently, Robin Li emphasized at the Dubai AI Summit that despite technological advances and cost reductions, there is still a need to invest in chips, data centers, and cloud infrastructure, and more computing power is needed to try different paths.

This is also a portrayal of the domestic giants’ gearing up for AI investment. The explosive DeepSeek is like a butterfly flapping its wings, triggering a new round of competition in the technology industry.

Not long ago, Alibaba Group CEO Wu Yongming announced that Alibaba will invest more than 380 billion yuan in the next three years to build cloud and AI hardware infrastructure, a total of more than the sum of the last decade.

Coincidentally, Liang Rubo, CEO of ByteDance, said at the all-staff meeting a few days ago that the focus of ByteDance’s AI business this year is to pursue the upper limit of intelligence, not the performance of a specific product.

A new round of AI competition for large manufacturers is kicking off.

Entering China

Entering China