Jingdong released big moves one after another.

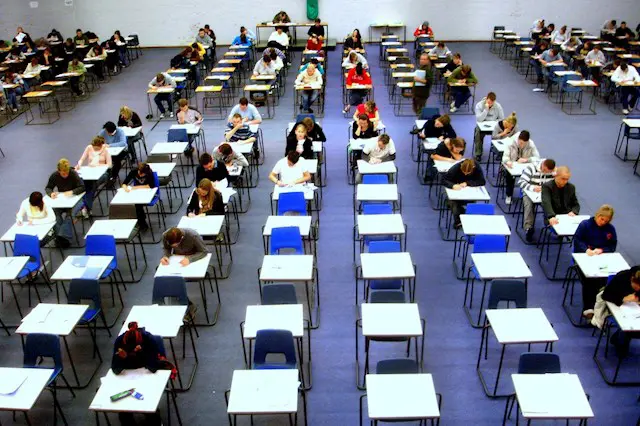

After merchants are commission-free and pay five insurances and one housing fund to riders, JD Takeaway has targeted the core consumer group – college students.

On February 27th, JD Takeaway announced the launch of the “10 yuan/20 yuan meal subsidy random collection” preferential activity, “10 yuan off over 15 yuan”, “20 yuan off over 40 yuan” two large meal supplement coupons can be randomly received at 8 o’clock every night, the first batch of college students and JD PLUS members who have passed JD certification.

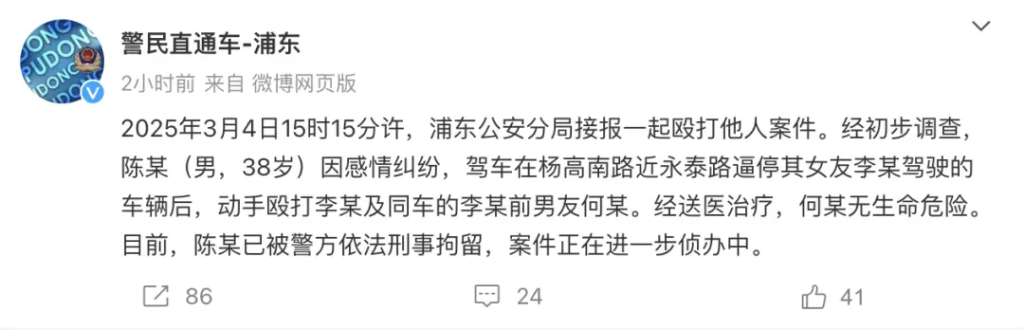

JD.com’s series of measures have made the long-dormant takeaway market agitated again. On the same day, Meituan increased its emphasis on quality catering, announcing that it would vigorously promote the “Bright Kitchen, Bright Stove, Sunshine Kitchen”, encouraging catering businesses to fully display the food processing process through live broadcasts in the kitchen.

After a few rounds, the top players competed in terms of rider benefits, merchant qualifications, and service experience…… A battle is underway for traffic and new business.

Seize the takeaway territory and leverage the army of 100,000 pushers

On the evening of February 27, college student Yanan waited on time on the coupon grabbing page of Jingdong Takeaway, grabbed a subsidy of 20 yuan, and bought a certain brand of milk tea at a price of less than 10 yuan.

“The coupon is cheaper than several other platforms, but the brands on the line are limited, most of them are still national chain brands, and the efficiency of distribution is not stable.” Yanan has experienced JD takeaway for two days in a row, and in her opinion, most consumers usually choose the platform based on delivery efficiency, category richness and price.

On the JD takeaway platform, large restaurant chain brands occupy a dominant position, such as Luckin Coffee, Grandpa Bu Tea, Drunken Noodles and other head brands have settled in, and the content of small restaurants and self-employed households is relatively small. However, the starting fee of JD Takeaway is low, taking Luckin Coffee as an example, the starting fee of JD Takeaway is 9 yuan, and the minimum delivery fee of other platforms is 20 yuan.

In order to make up for the shortcomings of the platform’s merchant categories, JD.com has activated an army of 100,000 local pushers, and has penetrated its tentacles into various business districts in first-tier cities and county-level cities.

On the digital promotion platform “Ren Tuibang”, as of February 28, the number of promoters of JD Takeaway exceeded 140,000, compared with more than 80,000 a week ago. Some third-party service promotion even lays out the front line to the Douyin live broadcast room, detailing the work content and salary system of the local promotion personnel.

Wang Qi, a local pusher in Guiyang, was attracted by the overwhelming recruitment advertisements on social media, many of which were urgently recruited, and some even put up slogans with a daily income of 1,000 yuan.

“Stores that have experience in doing takeaway are basically willing to settle in JD Takeaway.” Wang Qi told the Times Weekly reporter that on the first day of his post, he successfully promoted 6 restaurants in the core area, and each one can get a commission of 150 yuan, and can also receive a commission of 20 yuan from the team, “It is difficult for merchants to refuse the temptation of 0 commission, and they also want to develop consumer groups on the new platform.” ”

Wang Qi introduced that the audit standards of Jingdong Takeaway are high, and the settled merchants must provide information such as the business license of the head office, brand logo, food safety license, etc., resulting in a limited number of merchants who need to be screened in the early stage, and the review process takes at least three days.

The Times Weekly reporter learned through relevant business people of Jingdong that at present, Jingdong takeaway has been launched in 39 cities across the country, and the number of orders in some cities has increased by more than 100 times. As of February 20, nearly 200,000 catering businesses have applied to settle in.

Can JD.com surprise local life?

There is no shortage of challengers in the trillion-dollar local living market.

In 2023, Douyin will enter the food delivery track and compete head-to-head with Meituan, but it will be classified as the instant retail business “Hourda” under Douyin e-commerce due to capacity problems. Internet upstart Xiaohongshu is also eyeing local life, and recently announced that it will open the group buying function to all merchants in Chinese mainland, gradually deepening the layout of the industry.

“Short video platforms such as Douyin and Xiaohongshu are more suitable for undertaking short-term order explosions, and if businesses want to operate for a long time, they still have to pay attention to the operation of multiple local life platforms. In addition, effective usage scenarios must also be considered, such as opening Meituan mostly out of just needs such as ordering food or group buying, so the user completion rate is very high. Local life insiders told the Times Weekly reporter, “If Jingdong Takeaway wants to increase its market share, it must carry out long-term market education.” ”

Although the market can be opened with large subsidies in the early stage, once the front is extended, it is difficult for JD to avoid the problems of single volume and capacity.

Compared with the friend business platform, the pace experience of JD Takeaway is not stable enough. A number of users told the Times reporter that the delivery time was a few minutes later than expected, and it would take a while to see the rider take the order after placing the order.

Rider Li Hui has been running JD takeaway for a week, and he admitted that he entered the game with high unit prices and five insurances and one housing fund, but the single volume of the platform cannot compete with other platforms.

Li Hui said that if you run 8-10 hours a day, you can earn more than 400 yuan.

The entrance of JD Takeaway is relatively hidden and is classified as a subsidiary of JD Seconds. JD.com’s longer-term intention is to expand the real-time retail market with high-frequency scenarios, so that the takeaway business can supplement the order volume of JD.com’s second delivery.

According to media reports, after JD Miaosheng was promoted to a first-level entrance in the station, the number of daily active users was about 2 million. In comparison, according to data released by QuestMobile in October 2023, Ele.me has about 21.546 million daily active users, and there is still a large gap between the two.

Chen Liteng, a digital life analyst at the E-commerce Research Center of the Network Economic Society, said that looking at the catering takeaway market alone, Meituan and Ele.me occupy most of the market share.

“If JD wants to leverage the current takeaway market pattern, it needs to start from expanding merchant resources, optimizing service experience and certain subsidy policies, which is a relatively long-term process.” Chen Liteng added.

Entering China

Entering China