Gold is rising again and again!

According to a report by the International Business Daily on the 13th

Second week of 2025

The international gold price ushered in a significant rise

Cumulative increase of 2.27%

In 2024, the international gold price hit a record high of 40 times

More than 27% increase for the year

As the U.S. inflation data in the past two days released optimistic signals, the market’s expectations for the Federal Reserve to cut interest rates twice this year have risen, boosting international gold prices. As of Thursday’s close, the New York Mercantile Exchange gold futures for February delivery closed at $2,750.9 an ounce, up 1.22%.

“Snake Gold” is hot: someone “flies” to sweep the goods

Buy 20 pieces at a time

The reporter visited the gold sales market in many places and learned that as the Spring Festival approaches, gold jewelry with elements in the Year of the Snake is welcomed by consumers.

In the Shuibei Gold Market in Shenzhen, Guangdong, some gold jewelry with the theme of the Year of the Snake is also popular among consumers. Not only local residents came to buy, but also customers from other places who came by plane.

One consumer said that he came to Shenzhen from Hubei to buy gold jewelry, “whether it is the style or the price, we are still relatively satisfied”.

Some consumers said, “(Shenzhen) the price is very affordable, I bought about 20 pieces, there are more styles, and the workmanship is better.”

Chen Yan, a merchant in the Shuibei gold market in Shenzhen, Guangdong, told reporters that there are still a lot of gold wholesale and retail sales in the near future, according to the category, the snake ring and the chain sales are more, and the sales volume is two to three kilograms a day.

In a number of gold sales stores in Zhengzhou, Henan Province, the reporter noticed that although the gold price on the day of the interview was still maintained at about 620 yuan per gram, and the price of jewelry gold was also more than 700 yuan per gram, consumers who came to buy were still in an endless stream. Among them, gold jewelry such as curly snakes and lark snakes in the shape of the Year of the Snake are popular among young consumers.

Niu Lina, manager of a gold sales store in Zhengzhou, Henan Province: It sells very well. Compared to the previous month, it has basically doubled.

Chen Jing, manager of a gold store in Zhengzhou, Henan Province: There are also many orders for marriage and three golds, from January 1 to now, the customer flow has doubled to two times compared with usual, and there are also many large orders.

On the eve of the Chinese New Year, there are many couples who come to buy and customize wedding gold jewellery, and there are also many consumers who buy birthday jewellery for their children’s first birthday, and these consumers often buy gold jewellery in sets, and the weight of the gold jewellery is also higher.

A novel, fashionable and traditional cultural gift – gold stickers, has also become popular.

The gold gram weight of the sticker is between 0.01 grams and 1 gram, and there are various styles, including the auspicious God of Wealth, the beckoning cat, as well as well-known IP co-branded models, as well as blessings such as “Princess Please Make a Fortune” and “Peace and Joy”. Over the past few days, many local citizens and tourists from other places have come to Shuibei Gold Market to buy and give them to themselves or their relatives and friends as New Year’s gifts, adding a piece of good luck and joy to the New Year.

“This kind of mobile phone gold sticker in the transparent phone case, good-looking, expensive and fashionable, because the gram weight is relatively light, so the price is cheap, everyone can afford to consume, there are many people who buy more than a dozen, and some people buy more than 100 pieces, used as a company New Year’s goods or annual meeting lottery gifts. Mr. Lin, the owner of a stall, said that these gold stickers range from 20 yuan to hundreds of yuan, and the less gram weight is basically a fixed price, ranging from 20 yuan to 70 yuan.

The reporter found that many stores put 1 gram of rectangular stickers into New Year’s red envelopes as New Year’s red envelopes, attracting many consumers to buy. “Although the weight of gold per sticker is not large, it is real money after all, and it has a certain investment value. For young people, this is not only a New Year’s red envelope, but also an investment product with a value preservation function. The owner of a shop said.

It is understood that in order to take advantage of the festival market to attract customers and increase sales, various gold stores have also launched activities such as derogation discounts and reduction of processing fees. At present, the overall operating income of major shopping malls has increased significantly, and in order to meet the consumer demand of the market, shopping malls have also prepared sufficient goods in advance.

The high price of gold makes investors smile

From the beginning of last year to the end of the year, the international gold price fluctuated and rose, and in 2024, the international gold price hit a record high of 40 times, with an annual increase of more than 27%.

The quotation of the top gold jewelry brand Chow Tai Fook can also see a considerable increase: on January 12, 2025, the price of Chow Tai Fook jewelry gold was 825 yuan/gram, while the corresponding quotation on January 12, 2024 was 623 yuan/gram, which is equivalent to a price increase of 202 yuan per gram of jewelry gold in a year, an increase of more than 32%.

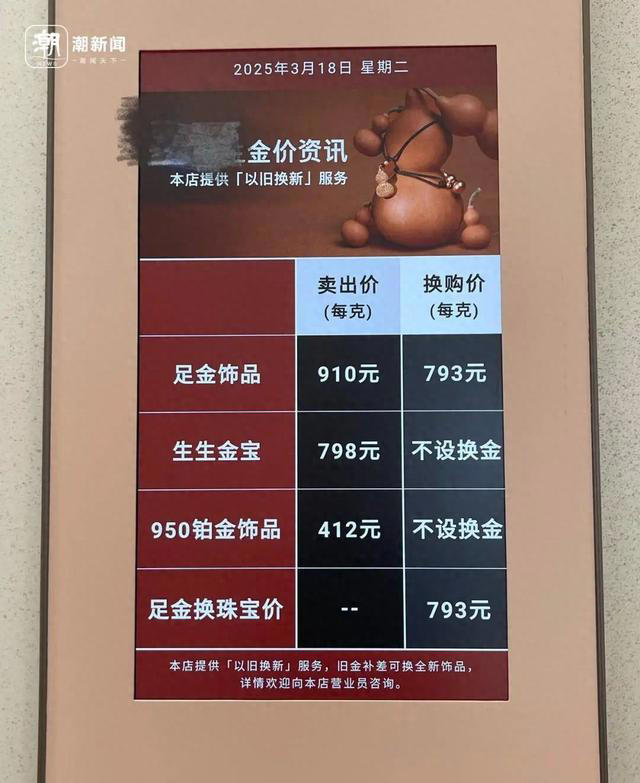

The high price of gold has allowed gold investors to enjoy huge returns. Shen Wei, the person in charge of a gold jewelry company in Hangzhou, revealed that on the evening of March 1 last year, the gold recycling price was 482 yuan/gram, and a customer came to sell 6,000 grams and realized 2.89 million yuan. Don’t be happy, that five days a week, the gold price hit a new high, and within a week, this customer earned 140,000 yuan less.

“Witnessing history every day, this sentence is the most heard sentence this year. But that’s right, the price of gold has hit nearly 40 new highs this year, and we have not seen this market in more than 10 years in the gold business. ”

The price of gold has risen sharply, and fewer people are buying gold jewelry and more people are buying gold bars.

“When the gold price was at its highest this year, the basic gold price reached 640 yuan per gram, and the retail price of gold stores reached 826 yuan per gram. The largest amount of gold was collected in September, when I went to a customer in the west of Hangzhou to collect 16 kilograms of gold bars, and the price of recycled gold was 599 yuan/gram, and the customer sold as much as 9.58 million yuan at one time. ”

Shen Wei’s gold bars were recovered. Photo courtesy of the interviewee

“The price of gold has risen like this, if it is not just needed, it is still cost-effective to buy gold bars! Because the base gold price is cheaper and the cost of circulation is lower, there will be less depreciation when buying back later. Ms. Gao, a gold investor, said.

Ms. Gao told reporters that last year, she originally wanted to buy gold jewelry, she saw the rise in international gold prices, and immediately “transferred” to the bank to invest in a gold bar. ”

With the soaring international gold price, the gold jewelry market has indeed cooled down a lot. According to the data of the China Gold Association, in the first half of 2024, the national gold consumption was 523.753 tons, of which 270.021 tons were gold jewelry, a year-on-year decrease of 26.68%; gold bars and coins were 213.635 tons, up 46.02% year-on-year.Gold prices soared, and gold stores were “hard to bear”

In this rally, the gold market has experienced unprecedented fragmentation: high-end consumers are chasing value preservation attributes, younger groups are turning to value performance, and traditional gold retailers are in unprecedented operational difficulties.

Even the record high gold price has made gold shops miserable, and it is difficult for “Chow Tai Fook” to bear the pressure.

As of the end of September 2024, Chow Tai Fook’s turnover in the first half of the year was HK$39.4 billion, down 20% year-on-year; The net profit attributable to the parent company was HK$2.5 billion, a year-on-year decrease of 44%. Not only that, Chow Tai Fook also unexpectedly ushered in a “wave of store closures”, closing more than 200 stores within half a year.

In addition, Zhou Dasheng and Lao Fengxiang’s revenue and net profit in the first three quarters of 2024 have declined year-on-year; Chow Sang Sang’s revenue and net profit in the first half of the year showed a double-digit year-on-year decline; Although Caibai’s revenue in the first three quarters increased by 24.06% year-on-year, the net profit attributable to the parent company decreased by 6.32% year-on-year.

Why is the surge in gold prices affecting the performance of jewellery companies? According to the manager of Chow Tai Fook in Jiangsu, the current gold industry is seriously involuted, the homogenization of commodities is serious, with the continuous rise in gold prices, the cost advantage of large-scale development no longer exists, and large brands and small brands are facing the same problems, which require brand transformation and differentiated competition paths.

Some experts pointed out that “luxury” may be an inevitable trend in the development of the jewelry industry, focusing on a symbol of noble status, while popular jewelry brands may gradually withdraw from the market and encounter elimination.

In the eyes of the outside world, this wave of gold prices has skyrocketed, and the merchants of Shenzhen Shuibei must have made a lot of money, but this is not the case.

Taking the vane of gold popular distribution transactions – Shenzhen Shuibei Gold and Jewelry Trading Center as an example, there are few questions in front of the counter of traditional gold stores, and new merchants who have entered the industry have revealed that the average monthly loss is 30,000 ~ 60,000 yuan.

“After entering the industry, the average monthly loss is 30,000 ~ 60,000 yuan, this line is really too rolly, and there will always be a counter with lower labor costs than you in the mouth of customers.” Zhang Shuang, a merchant in the Shuibei market, revealed that the low labor cost in Shuibei has exceeded his imagination, and there is even a quotation of 0 yuan for the dragon and phoenix bracelet and 3 yuan for the suquan circle, and he must quickly find the path of differentiated operation.

The counter has been in operation for more than 4 months, and due to the lack of sales experience and jewelry resources, Zhang Shuang faced a number of problems: the gold price was too high to take the goods, there was no stable source of customers, and labor costs and rental costs were superimposed every month……

In the face of multiple difficulties, Zhang Shuang said frankly that he had not considered the transformation into the current popular “imitation gold” and “gold and silver” products. “Some of my peers, such as imitation big-name gold jewelry, luxury jewelry, and diamond products, are really cheap, and the cost is also very low, and young people can afford it. But in the final analysis, they are all imitations, which infringe on the intellectual property rights of legitimate brands. ”

“We strictly inspect the sale of fakes, facelifts, and high imitations in the Shuibei market, and I think this is the right thing to do, and I still prefer original designs or regular gold products.”

The good news is that since mid-December 2024, the number of customers in the Shuibei market has been significantly higher than usual, and Zhang Shuang has also taken advantage of the peak holiday period to buy gold, launched a series of innovative products such as gold coins, gold banknotes, necklaces and rings with the theme of the Year of the Snake, and set up live broadcast channels on various e-commerce platforms to sell products.

“I obviously feel that the sales of snake-like products have increased by 2~3 times compared with usual, and the daily passenger flow has increased by about 50% compared with last month since this month, especially on weekends, and employees can’t receive them.” Zhang Shuang expects the seasonal factor to last a little longer.

Past performance is not a basis for future investments

With the gold market rising sharply for the second year in a row

Is the gold market still worth participating in in 2025?In 2025, the gold market may rise or slow down

According to the report of the national through train, many experts believe that in 2025, gold prices are expected to start a new round of upward cycle, and the overall will be weak in shocks.

Looking ahead, geopolitical risks and the increase in central bank gold reserves will continue to support gold prices, although international gold prices may fluctuate due to a variety of factors. Therefore, it is expected that the international gold price will continue to maintain a strong momentum for a certain period of time. At present, by the end of 2025, $3,000 per ounce is still the expected price of international gold prices by many analysts.

“Gold prices are set to hit new highs in the coming year.” In this regard, global precious metals service provider Heraeus expects gold prices to rise to $2,950 per ounce in 2025 as the world’s major central banks cut interest rates further and the dollar weakens. “Geopolitical risks remain, global central banks are expected to continue to buy gold, and investment in gold-backed ETFs is expected to grow again.” This was stated by Henrik Marx, Head of Precious Metals Trading at Heraeus.

Most research institutions are still optimistic about the future of gold. In the view of research institutions, there are still many factors supporting the gold market in 2025, on the one hand, investors are facing a lot of uncertainties, in addition to the turbulence of geopolitical situation, there are also uncertainties in the process of economic recovery; On the other hand, as a long-term supporting factor, the diversification of global central banks’ reserves will continue, and the trend of major central banks increasing their holdings of gold reserves is difficult to reverse.

However, institutions are still divided on the pace of market movements. “In the first half of 2025, there may be certain unfavorable factors, or the precious metals market may slow down or even fall, and the second half of the year may resume the upward trend.” In this regard, the analysis of China Securities Construction Investment Futures and other institutions also believes that in the gold market in 2025, investors still need to pay attention to the three major risk points that may occur.

Since the third quarter of 2024, the U.S. dollar exchange rate has strengthened significantly, and industry analysts believe that with the change of the U.S. government, the proposed tax cuts and tariff policies are likely to raise the inflation level in the U.S. market, which may force the Federal Reserve to maintain higher interest rates for a longer time, thereby providing support for the U.S. dollar; Second, the phased cooling of geopolitical risks, especially with the shrinking of the US diplomatic strategic focus, geopolitical turbulent factors such as the Ukraine crisis and the Palestinian-Israeli conflict may temporarily cool down, thereby reducing the market’s risk aversion; Third, gold has multiple attributes, although the impact of commodity attributes on its price fluctuations is small, but with the rise in gold prices, the significant growth of the recycling market and the suppression of consumer demand have offset the growth of physical investment demand to a certain extent.

“From a full-year perspective, the market may rise in 2025 or lower than in 2024.” In the view of many industry experts, the long-term investment value of the gold market continues to be highlighted, but the interpretation of the market remains to be seen, especially as one of the safe-haven investment products, the disturbance of new risk factors in the future still needs to be paid attention to.

Entering China

Entering China