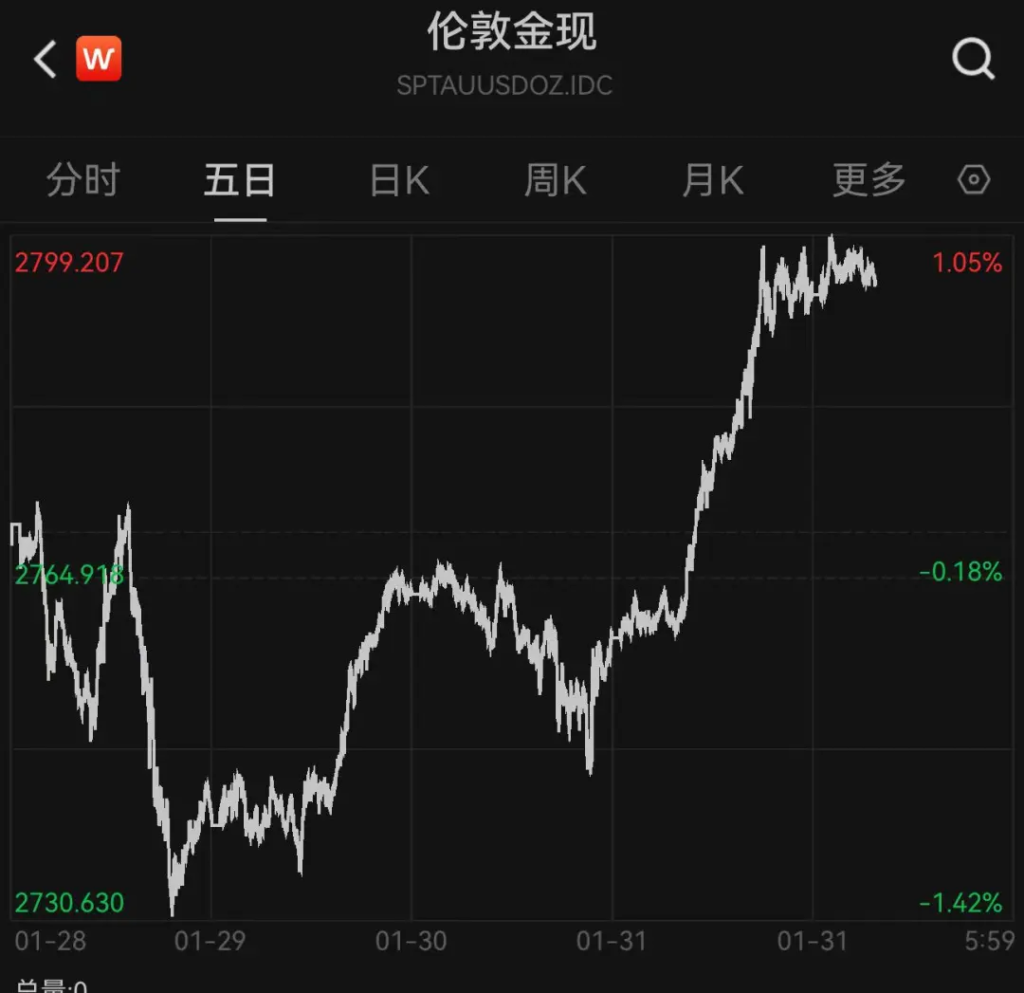

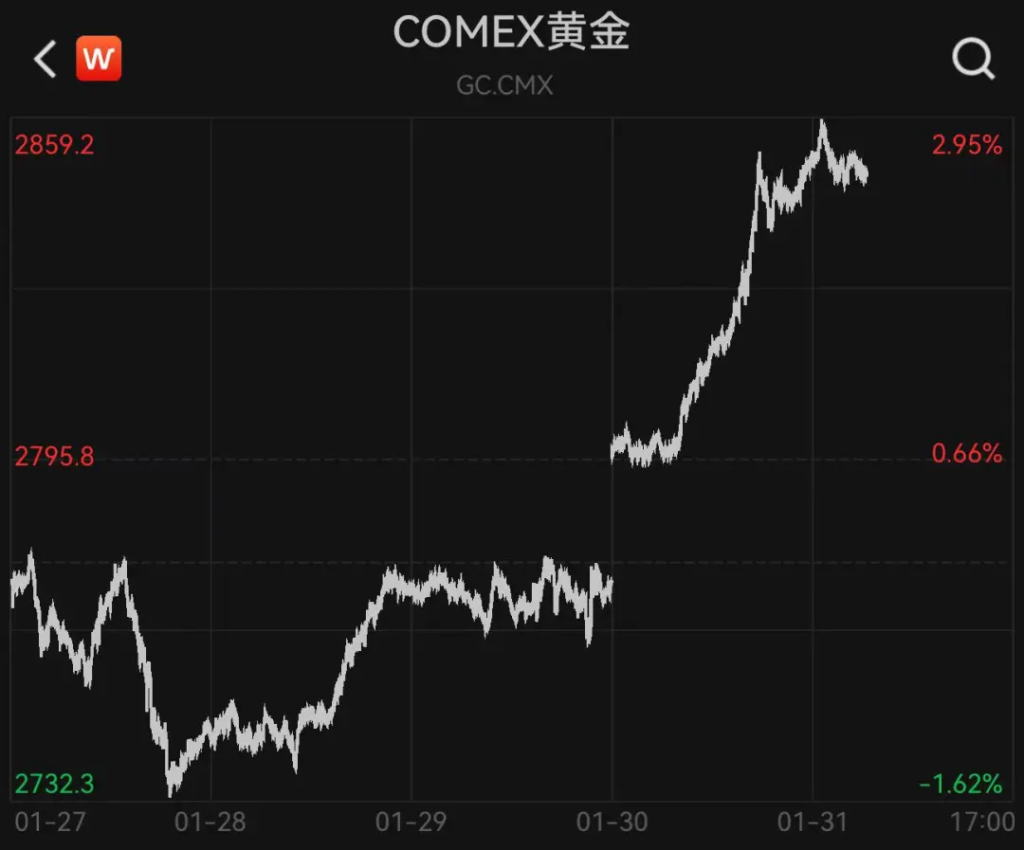

On January 31, the international gold price continued to rise, hitting a record high intraday, as of press time, spot gold rose to 2794.53 US dollars / ounce; COMEX gold futures rose to $2848.9 an ounce. The price of pure gold jewelry in China has also risen, and 1 gram has exceeded 846 yuan.

According to the analysis, the Trump administration’s tariffs on major trading partners may trigger trade frictions, coupled with the uncertainty caused by global geopolitical conflicts, and many central banks have increased their holdings of gold, which makes some investors continue to be optimistic about gold’s safe-haven properties and upside.

Gold prices soared1 gram of domestic pure gold jewelry exceeded 846 yuan

Gold fever is still high!

On January 31, the international gold price continued to rise sharply. As of press time, spot gold rose as high as $2,799.86 per ounce, refreshing a record high; COMEX gold futures rose as high as $2,859.5 an ounce, refreshing an all-time high.

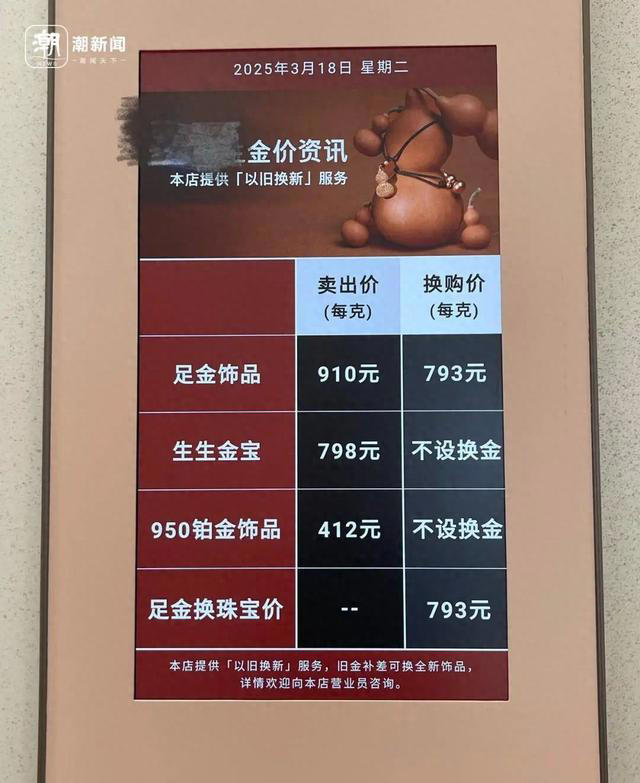

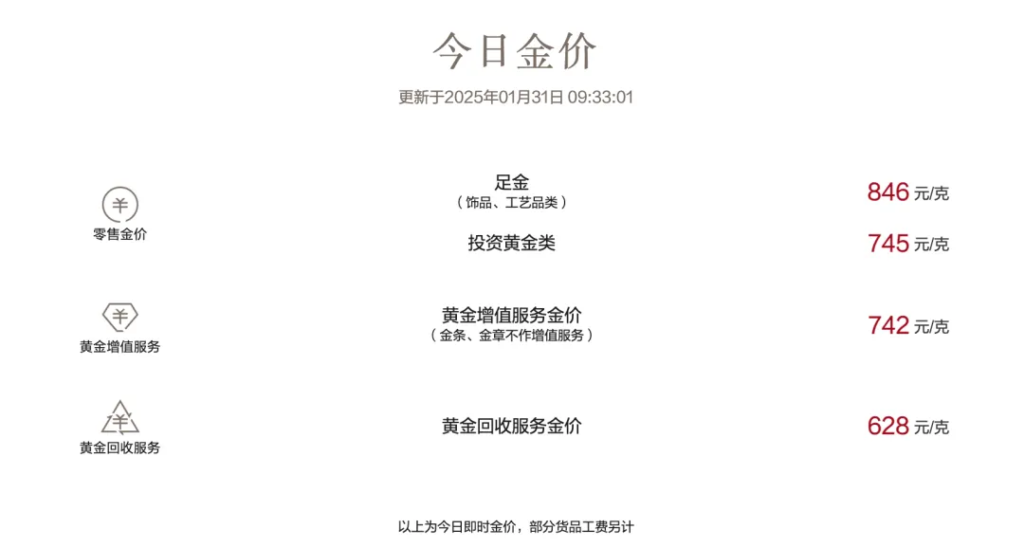

In the retail market, jewellery prices have risen as the international gold price has soared. On January 31, the price of pure gold jewelry in many domestic gold stores has reached 846 yuan/gram.

Image source: Chow Tai Fook website

Image source: Chow Sang Sang website

With the arrival of the Spring Festival, people are keen to add gold to the New Year, and the gold consumption market has entered the traditional peak season.

The gold shops in Shanghai are also very lively, and at noon on January 30, the gold shops in the Shanghai Global Harbor shopping mall welcomed many consumers, among whom a relatively high proportion are young people. Fashionable small pendants, or products in cooperation with popular IPs, are popular choices for everyone.

In addition, some traditional gold jewellery is still popular with consumers. During the Spring Festival, single-store sales doubled compared to usual.According to the South + report, industry insiders told reporters that during the Spring Festival, consumers’ enthusiasm for buying gold is mainly due to the following reasons:

First, it mainly stems from the need to please oneself and give gifts. Many consumers choose to treat themselves to gold jewellery or give it as a gift to friends and family, as it symbolizes good luck and blessings for the New Year.

Second, gold, as a traditional hedging asset, is favored by many investors. Despite the high price of gold in 2025, there are still consumers who believe that it has investment value, especially in the context of increased economic uncertainty, and gold’s safe-haven properties remain attractive.

Third, 2025 is the Year of the Snake, andmany gold brands have launched snake-themed jewelry products, such as gold jewelry and transfer beads with the theme of the Year of the Snake, which are loved by consumers because of their unique cultural meaning and design.

There is also a group of young people who are reducing the cost of obtaining gold jewellery by “buying gold bars + striking gold”. In Beijing, a gold striking shop told reporters that gold mining needs to be booked at least one day in advance, and there may be many waiting days when there are many people. Another gold striking shop said that the store does not accept reservations and needs customers to queue up on the spot. “Because of the holiday, there have been more customers recently, and I’m not sure when it will be on the day, but we don’t close for the Spring Festival.” Xiaoxiao, a post-90s consumer in Guangzhou, said that in order to catch up with the first round of processing in the gold shop, she rushed over to line up before the store opened at half past seven in the morning. “Because the labor fee is cheap, the store that opens at half past nine o’clock, many people come to line up at seven or eight o’clock to grab the number.” Xiaoxiao said, “Recently, the price of gold has been too high, and it is really a bit painful to buy branded gold jewelry!” After waiting for more than 5 hours, Xiaoxiao finally got her new gold bracelet from the gold counter.

On social platforms, many netizens shouted that the price of gold had risen too fast, and they regretted not hoarding more before.

Gold will still have allocation value in 2025

Looking ahead to 2025, a number of fund managers said that they still need to increase the importance of gold assets in their asset allocation portfolios.

According to the brokerage China, Guotai Gold ETF Fund Manager Ai Xiaojun said that looking forward to 2025, although there is some uncertainty about the Fed’s interest rate cut path, but in the current global “de-dollarization” environment, it is difficult for central banks to choose gold to diversify their foreign exchange reserves in the short term. According to China’s latest foreign exchange reserve data, as of December 2024, China’s central bank held 73.29 million ounces of gold reserves, an increase of 330,000 ounces from November 2024. This is the second consecutive month since the central bank restarted gold purchases after half a year, and the pace of China’s central bank to increase gold holdings is expected to start again.

In its latest report, Gold Outlook 2025, the World Gold Council said that in 2025, the gold price is on track to record its best annual performance in nearly 10 years. After a strong rally in recent years, the growth of the gold market may slow in 2025, but there is still some upside. The potential upside for gold could come from the possibility of stronger-than-expected central bank demand, or from safe-haven inflows due to changes in financial conditions.

In addition, Trump’s America First strategy may further exacerbate global uncertainty, gold’s safe-haven advantage is highlighted, and its policy proposition of reducing domestic taxes and raising taxes externally may lead to a rise in the medium-term inflation center and an expansion of the fiscal deficit, which is good for gold.

Liu Tingyu, fund manager of Yongying CSI CSI Shanghai-Shenzhen-Hong Kong Gold Industry Equity ETF, said that both gold and gold stocks have room for further upside.

In terms of gold, the market’s expectations for interest rate cuts after the Fed interest rate meeting are a little overly pessimistic, and the subsequent stabilization of the U.S. economy will not be smooth sailing, and the number of interest rate cuts is likely to exceed market expectations. Global central bank gold purchases are a long-term trend, and the People’s Bank of China has resumed gold purchases after half a year, and other emerging market countries have also exceeded expectations, forming an important support for the long-term pivot of gold prices. The global monetary policy easing has led to the decline of global real interest rates, and Trump’s policy may trigger secondary inflation, rising deficit rates and rising global economic uncertainty, and the upside of gold this year cannot be ignored.

In terms of gold stocks, the current valuation of gold stocks is relatively cost-effective, and the rise in gold prices has stimulated gold mining companies to increase capital expenditure, and the output continues to grow, and the performance of gold industry companies in 2025 is expected. At present, the valuation of gold stocks according to the price-earnings ratio has fallen to the lower edge of the historical pivot, implying too many pessimistic expectations for gold prices, so if the domestic gold price rebounds, gold stocks may usher in a significant valuation repair. Investors who are bullish on gold prices can also focus on investment opportunities in gold stocks.

Entering China

Entering China